Tax Departments

The tax department allows you to create and enable up to three different tax types. You can name each tax and control whether it's activated or deactivated for your store.

LithosPOS allows you to create and apply multiple tax types, such as state and city taxes for US locations, as well as CGST, SGST, and cess for applicable regions.

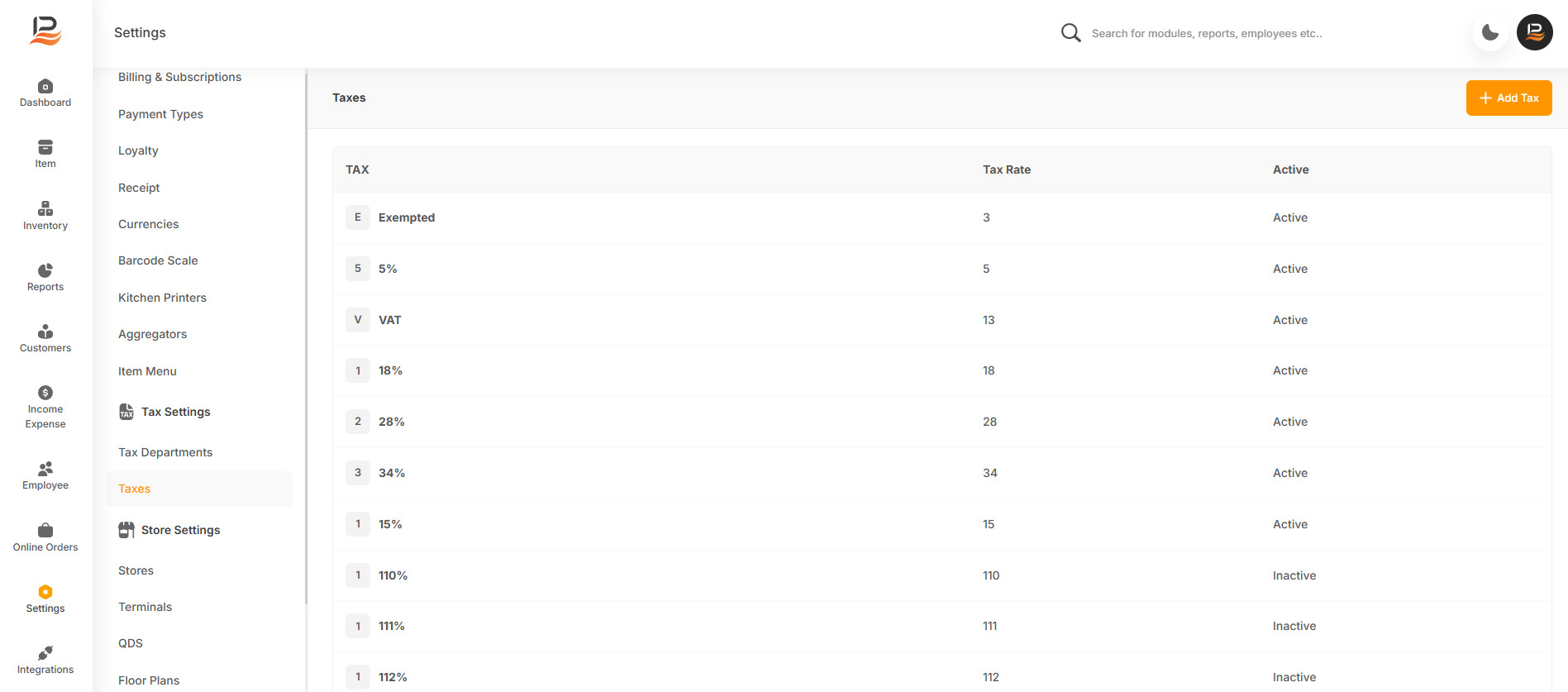

Taxes

You can create new tax rates within the tax settings. Once you've configured all necessary tax rates, you'll need to assign them to your store or specific products/items.

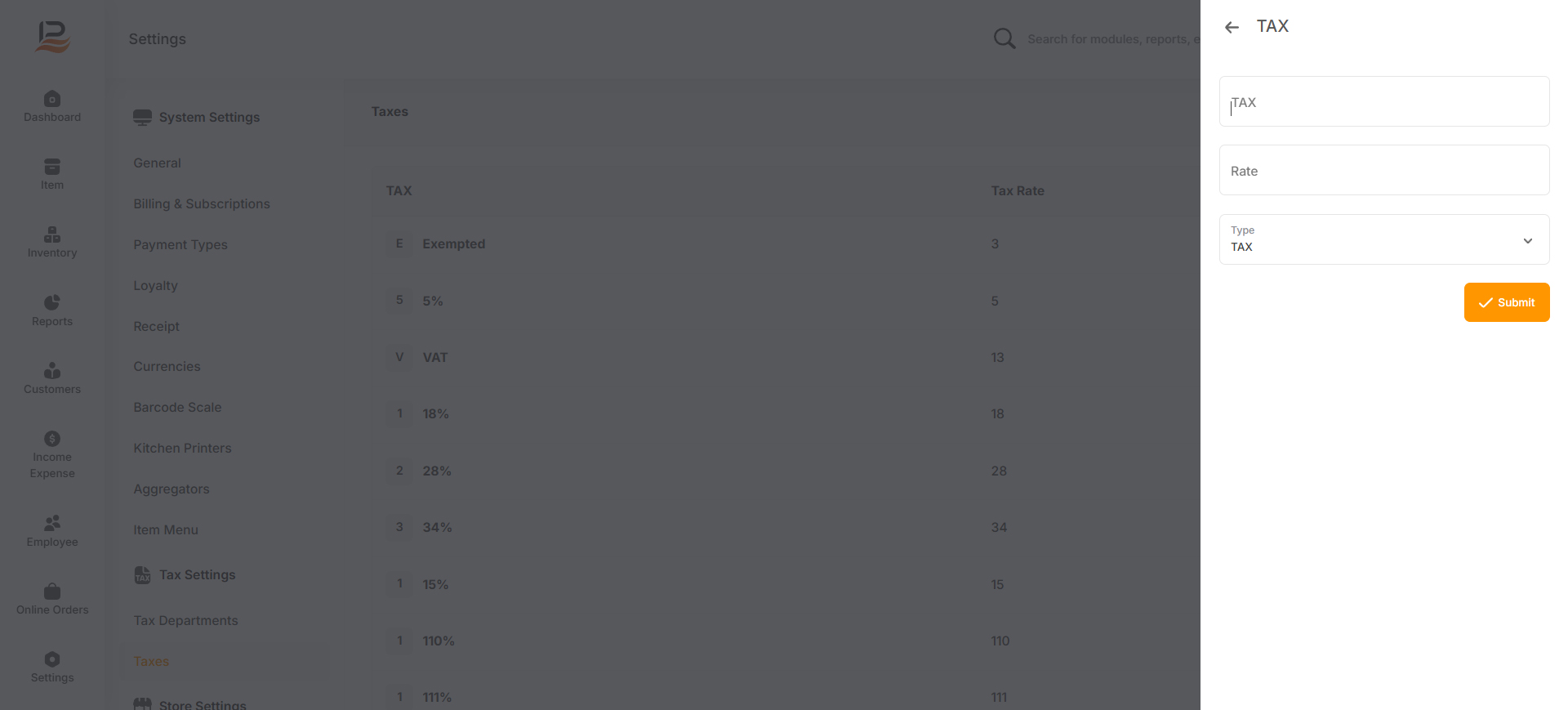

To create a new tax rate

LithosPOS allows you to manage different types of taxes

-

Go back office and navigate to Settings in the side menu, then go to ‘Taxes’.

-

Click on the Add Tax button on the top right.

-

A popup window will be displayed on the right side of the screen.

-

Enter a tax name.

-

Then input the tax percentage [Enter the digit without the % icon]

-

Select your preferred tax type from the dropdown menu.

-

Finally, click submit

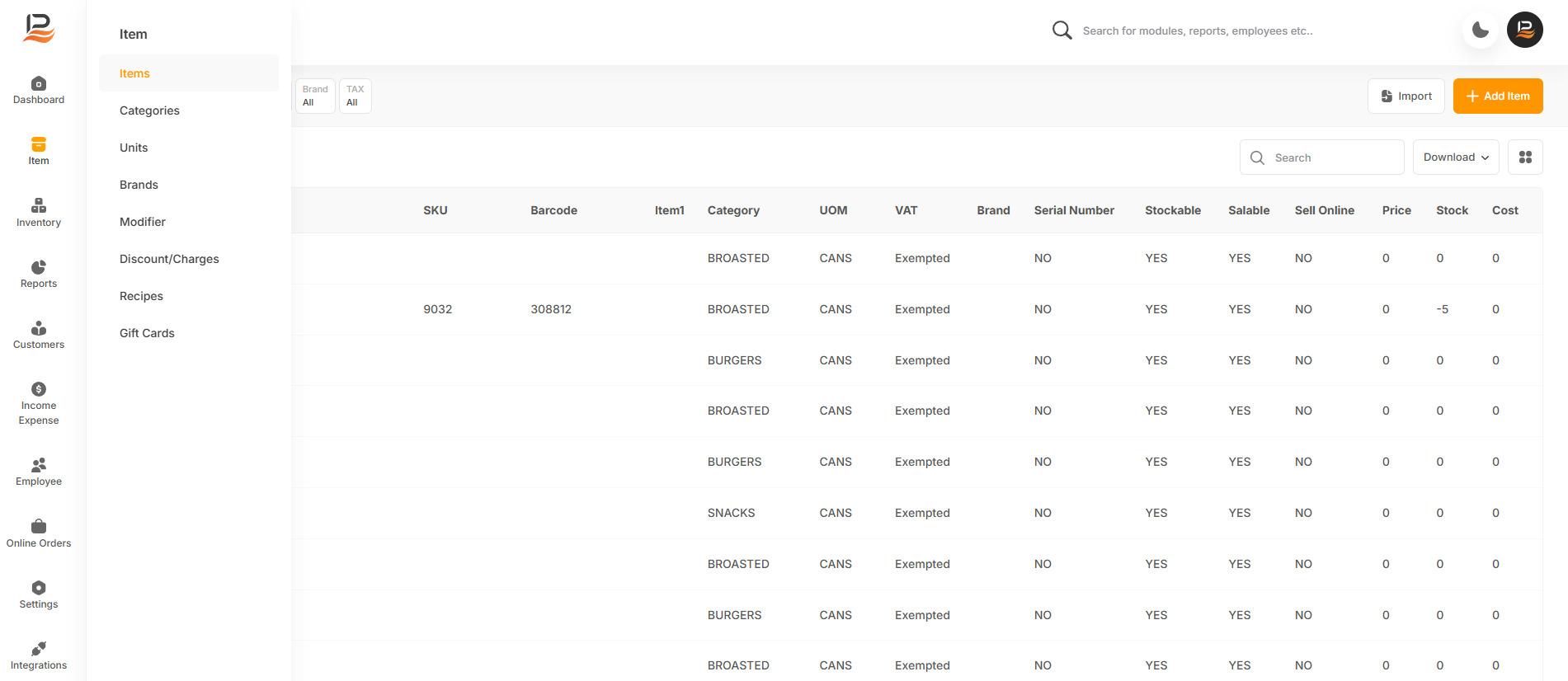

Apply your tax rates to products

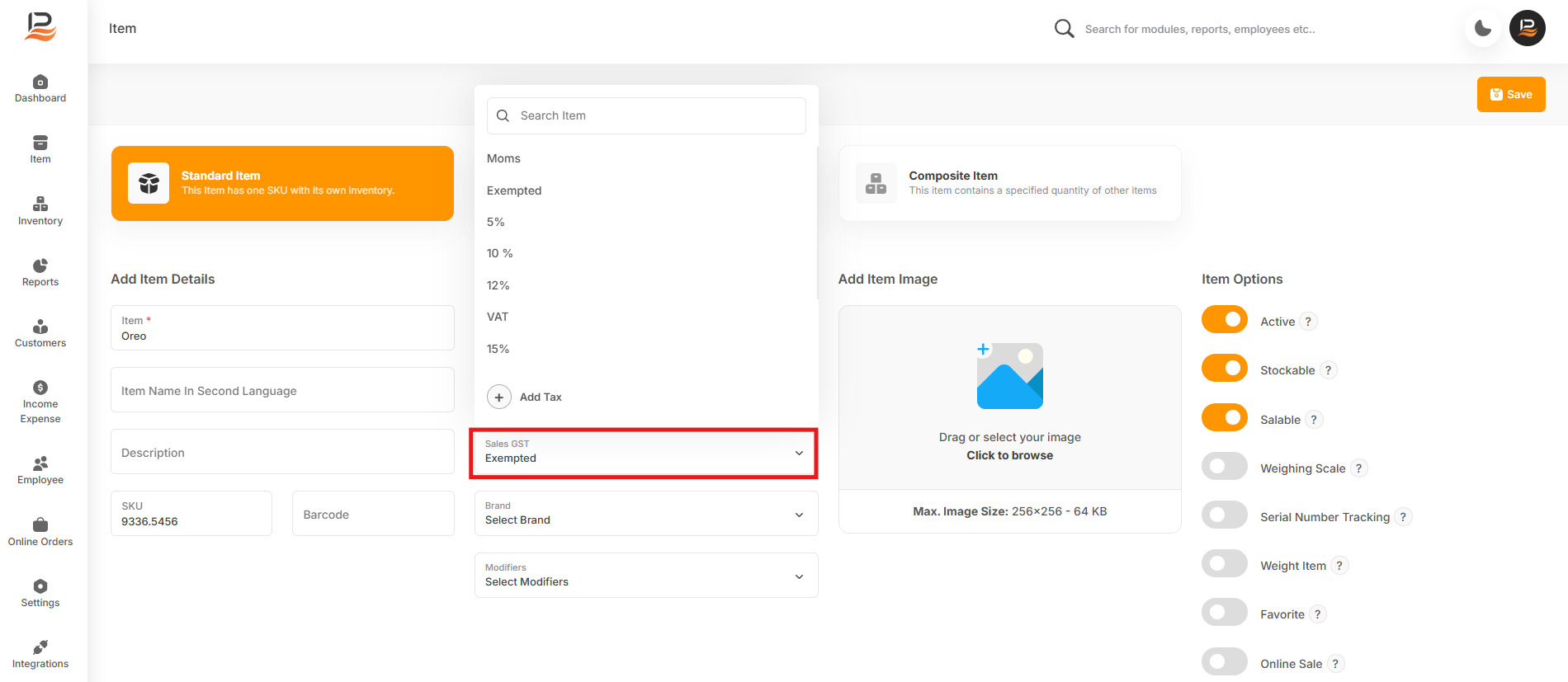

To assign a tax to a specific Item

-

Navigate to ‘Item’ in the side menu and click on ‘Items’

-

From the item list select the item you desire and open it.

-

Click on the taxes, select the Tax you desire.

-

Save the item.

Connect with us to know more

To learn more about it feel free to book a meeting with our team

LithosPOS

LithosPOS